The Trump administration’s decision to double tariffs on Indian goods to 50% within almost a week has dramatically escalated trade tensions between the two nations. This protectionist measure, targeting USD 64 billion worth of Indian exports, including steel, aluminum, textiles, and electronics has been justified by the U.S. as a response to India’s continued reliance on Russian oil. New Delhi vehemently condemns the move, labeling it as “economic coercion.” A warning of potential retaliatory measures is indicated in the statements issued.

Economic Fallout: GDP Shock

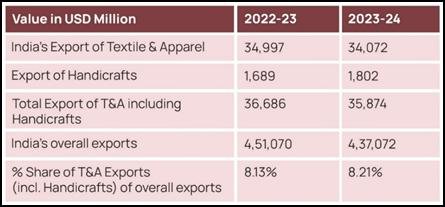

The economic repercussions for India could be severe, with analysts projecting a potential loss of up to 1% in GDP growth. Labor-intensive sectors such as textiles and manufacturing are especially vulnerable, with millions of jobs at risk if the tariffs remain in place. India’s steel and aluminum exports alone are expected to take more than USD 1 billion hit. The textile industry which contributed USD 34.4 billion in exports in 2023-24 and employs over 45 million people, with apparel constituting 42% of the export basket, followed by raw materials- semi-finished materials at 34% and finished non-apparel goods at 30% will face devastating disruptions. It is to note that the textile sector is the second largest employment generator, after agriculture. The electronics sector, a cornerstone of Prime Minister Modi’s ‘Make in India’ initiative, is also under existential threat as key components like printed circuit boards become prohibitively expensive to export.

Source- PIB

Macroeconomic and Market Repercussions

While Warren Buffet once said- The most important quality for an investor is temperament, not intellect. But Indian investors are particularly in favour of diversifying trade and retaliatory measures rather than restraint. The Indian rupee has weakened, and volatility has surged, reflecting investor anxiety. Meanwhile, India’s reliance on Russian oil remains robust, with imports hitting nearly 2 million barrels per day (bpd) in August 2025 among the highest levels since Russia’s invasion of Ukraine in 2022, despite U.S. and EU sanctions. Discounts on delivered Russian crude oil are already at record lows of below USD 2 per barrel.

Strategic Dilemma: Diplomatic Balancing Act

The U.S. tariff decision risks alienating a key strategic partner in the Indo-Pacific at a time when Washington is seeking to counterbalance China’s influence. Analysts warn of an uncomfortable paradox- while the tariffs aim to punish India for its ties with Russia, they may inadvertently push New Delhi closer to Beijing. Prime Minister Modi’s upcoming visit to China, his first in over seven years signals a potential diplomatic thaw with Beijing amid rising tensions with the U.S. This creates a strategic nightmare for Washington’s Indo-Pacific containment strategy, forcing India into a delicate balancing act between economic interests and diplomatic relations. It is largely believed that the US is making Chinese products more competitive through its tariff arsenal. When looking at the growth of the Chinese economy, it showcased strong growth in the month of June.

Retaliation vs. Restraint: India’s Policy Options

India’s Commerce Ministry is weighing several countermeasures, including targeted tariffs on U.S. agricultural exports, particularly soybeans and almonds. Industries are also demanding anti- dumping duties in response to this imposition. Pharmaceutical export restrictions, given that 40-50% of U.S. generic drugs originate in India. Trade diversification into EU and ASEAN markets to reduce dependence on the U.S seems a viable option now. Some firms, like Jindal Stainless, India’s largest stainless steel maker, are mitigating losses by focusing on domestic demand in infrastructure, automobiles, defense, and aerospace. However, demand in key European markets remains sluggish, exacerbating the challenge.

Long-Term Structural Adjustments

The tariffs may force painful but necessary structural reforms. Former RBI Governor Raghuram Rajan has long warned that India’s export basket lacks diversification, stating that this crisis exposes India’s persistent export basket rigidity, we’re still selling 2020 products in 2025 markets. Potential long-term shifts include Domestic Consolidation because smaller exporters may collapse, while conglomerates like Reliance adapt. Policy reforms are required so that the shock could catalyze long-delayed labor and land reforms.

Some analysts see opportunities in the turmoil. Import Substitution, Trade Rebalancing and Innovation Push making India from assembler to an innovative economy. While negotiations are ongoing, economists anticipate a partial compromise, possibly exemptions for pharmaceuticals and IT services. However, the fundamental reality remains unchanged- the importance of bilateral talks and negotiations. Policymakers’ responses will determine whether this becomes a temporary setback or serves as an opportunity in India’s growth trajectory. One thing is certain, in this era of economic nationalism, no developing economy is safe from geopolitical crossfire.